The Only Guide for How Do You Get A Copy Of Your Bankruptcy Discharge Papers

Table of ContentsRumored Buzz on Copy Of Chapter 7 Discharge PapersThe Main Principles Of How Do You Get A Copy Of Your Bankruptcy Discharge Papers How Do I Get A Copy Of Bankruptcy Discharge Papers for BeginnersThe Only Guide to How Do You Get A Copy Of Your Bankruptcy Discharge PapersThe Ultimate Guide To Copy Of Bankruptcy DischargeSome Known Factual Statements About How To Get Copy Of Bankruptcy Discharge Papers

This shows lenders that you're major about making an adjustment in your monetary situation and elevating your credit rating in time. Reduced levels of financial debt can likewise assist you qualify for a home mortgage. The fastest as well as most convenient method to elevate your credit report is to make your bank card and also funding payments on routine each month - copy of bankruptcy discharge.

Getting preapproved is vital for a couple reasons: First, a preapproval letter allows you recognize which houses remain in your budget and enables you to tighten your residential or commercial property search. Second, a preapproval informs property agents and sellers that you can safeguard the financing you require to purchase the house you wish to make an offer on.

Unknown Facts About Obtaining Copy Of Bankruptcy Discharge Papers

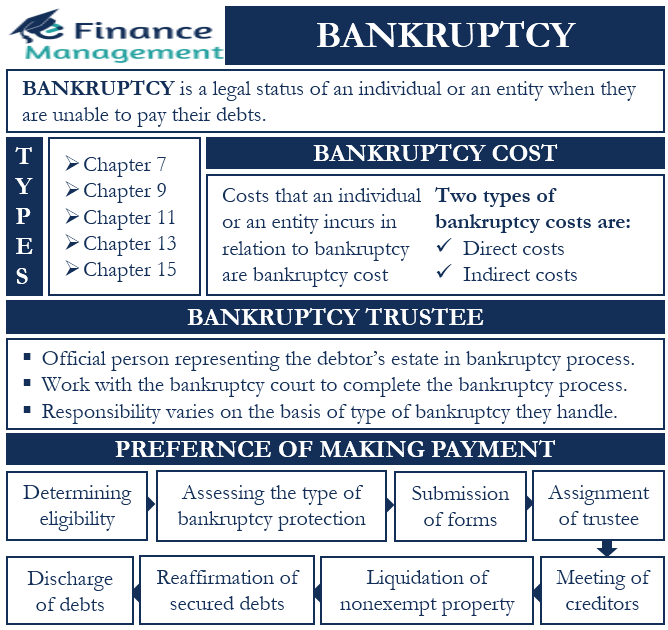

The right to file for insolvency is given for by government law, and all insolvency instances are taken care of in federal court. In a Chapter 13 case, you file a plan revealing just how you will certainly pay off some of your past-due and also current debts over a prolonged period, usually 3 to 5 years. After you finish the strategy, the unsettled equilibrium on particular financial debts might be cleaned out.

This implies that you gave the financial institution a mortgage on your residence or put your residential or commercial property up as security for a financial debt. If you don't make your payments on the financial debt, the lender might be able to take as well as sell the residence or residential property.

The smart Trick of Chapter 13 Discharge Papers That Nobody is Discussing

If you lag in your settlements, the court in a Phase 13 insolvency can offer you time to capture up. For some sorts of residential or commercial property, you can pay the lender the amount that the residential property deserves instead than the full financial obligation. If you set up your family products as collateral for a financing, you might have the ability to maintain them without making anymore repayments on the debt.

The reality that you've submitted a bankruptcy can show up on your credit report document for 10 years. Because personal bankruptcy wipes out your old financial obligations, you should be in a much better placement to pay your current expenses, so personal bankruptcy may really aid you get credit score.

Each case is different. This handout is meant to provide you basic details and not to provide you certain lawful advice. Please utilize the details located in this brochure thoroughly considering that the regulation is constantly altering as well as the info may not precisely reflect any kind of modifications in the regulation that occurred following the development as well as magazine of the sales brochure.

8 Easy Facts About How To Get Copy Of Chapter 13 Discharge Papers Described

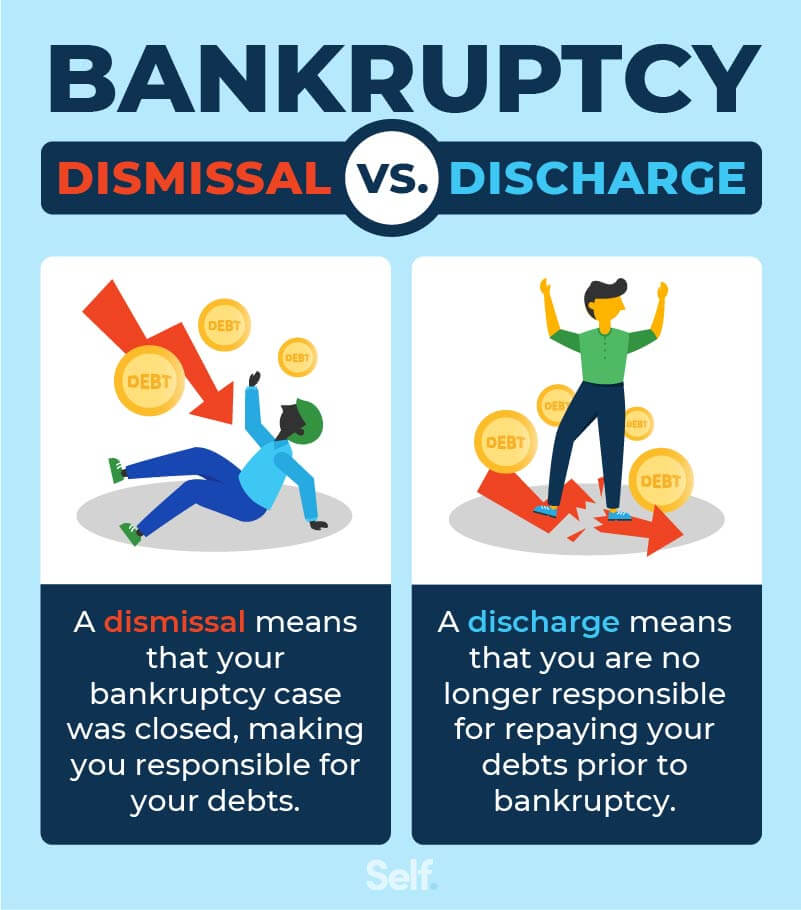

What is a bankruptcy discharge, and also how does it work in Georgia? When a financial debt is discharged in a Phase 7 case, a financial institution is for life disallowed from launching or continuing collection initiatives.

Financial debts also have to be unsecured, implying there is nothing for the lender to take if the financial obligation is released. In addition, just financial debts that emerged prior to a personal bankruptcy was submitted are dischargeable. As an example, if a debtor documents for past due amounts on their electric bill, only the amount that was sustained before the personal bankruptcy declaring can be released.

What Does How To Get Copy Of Bankruptcy Discharge Papers Do?

Yes. The fact that you've filed an insolvency can show up on your credit report document for one decade. Yet since bankruptcy eliminates your old financial obligations, you should be in a better setting to pay your present costs, so insolvency might really assist you get credit report. An utility, such as an electrical business, can not decline or cut off solution due to the fact that you have actually filed for bankruptcy.

When an individual data for Phase 7 bankruptcy, their purpose is to have as many of their financial debts discharged as feasible (https://public.sitejot.com/b4nkruptcydc.html). However what is an insolvency discharge, and also how does it work in Georgia? When a financial debt is discharged in a Chapter 7 proceeding, a financial institution is for life barred from starting or proceeding collection initiatives.

Top Guidelines Of How Do You Get A Copy Of Your Bankruptcy Discharge Papers

If a financial institution does start or continue collection initiatives on a financial obligation that has actually been released in bankruptcy, they remain in violation of the united state Bankruptcy Code and also might encounter charges and various other sanctions. Examples of activities a lender can no much longer take after a financial obligation has actually been discharged consist of the following: Sending letters Calling Taking lawful action to gather on a financial debt It is very important to keep in mind that not all financial obligations are dischargeable in a Phase 7 insolvency.

Debts likewise need to be unsecured, indicating there is absolutely nothing for the lender to take if the financial debt is discharged. Just financial debts that occurred before a personal bankruptcy was submitted are dischargeable. If a borrower documents for past due quantities on their electric bill, only the amount that was incurred prior to the insolvency declaring can be released.